Financial Results for the Quarter and Nine Months Ended September 30, 2024

- For the quarter ended September 30, 2024, net income attributable to common shareholders was $288.7million, or $2.31 per diluted share, compared to net income attributable to common shareholders of $120.1million, or $0.97 per diluted share for the same period in 2023.

- For the nine months ended September 30, 2024, net income attributable to common shareholders was $313.4million, or $2.51 per diluted share, compared to a net loss attributable to common shareholders of $132.4million, or $1.07 per diluted share for the same period in 2023.

Non-GAAP Financial Measures

- Core Funds from Operations (“Core FFO”) for the quarter and nine months ended September 30, 2024, was $2.34 per common share and dilutive convertible securities (“Share”) and $5.39 per Share, respectively, as compared to $2.57 and $5.76 for the same periods in 2023.

- Same Property Net Operating Income (“NOI”)

- North American Same Property NOI increased by $1.9 million and $31.3 million, or 0.5% and 3.6%, respectively, for the quarter and nine months ended September 30, 2024, as compared to the corresponding periods in 2023.

- UK Same Property NOI decreased by $0.7 million, or 2.3%, for the quarter ended September 30, 2024, and increased by $4.3 million, or 7.7% for the nine months ended September 30, 2024, as compared to the corresponding periods in 2023.

“Year-to-date we have achieved solid growth across our MH, annual RV, marina and UK segments, while continuing to see the volatility in the transient components of our business. Additionally, our third quarter performance reflects the impact of cost pressures which resulted in earnings and revised full year guidance that were below our expectations, and we are not satisfied with our results,” said Gary A. Shiffman, Chairman and CEO. “We have continued to execute on our strategic priorities of recycling non-strategic assets, reducing debt, and increasing the revenue contribution from annual real property income, and we are now also implementing a broad restructuring effort to more effectively align the Company’s cost structure to deliver sustainable earnings growth. The fundamentals underlying our business and real estate assets remain strong, we anticipate strong rental rate increases next year, and we are confident that by continuing to execute on these strategic priorities, we will position the company for more stable growth in the coming quarters and demonstrate our long-term value.”

OPERATING HIGHLIGHTS

North America Portfolio Occupancy

- MH and annual RV sites were 97.7% occupied at September 30, 2024, as compared to 97.2% at September 30, 2023.

- During the quarter ended September 30, 2024, the number of MH and annual RV revenue producing sites increased by approximately 1,050 sites, as compared to an increase of approximately 740 sites during the corresponding period in 2023, an increase of approximately 42%. Transient-to-annual RV site conversions during the quarter ended September 30, 2024 accounted for approximately 85% of the gains.

- During the nine months ended September 30, 2024, MH and annual RV revenue producing sites increased by approximately 2,500 sites, as compared to an increase of approximately 2,590 sites during the corresponding period in 2023, a decrease of approximately 3%. Transient-to-annual RV site conversions during the nine months ended September 30, 2024 accounted for approximately 79% of the gains.

Same Property Results

For the properties owned and operated by the Company since at least January 1, 2023, the following table reflects the percentage changes for the quarter and nine months ended September 30, 2024, as compared to the same periods in 2023:

| Quarter Ended September 30, 2024 | ||||||||||||||

| North America | ||||||||||||||

| MH | RV | Marina | Total | UK | ||||||||||

| Revenue | 6.4 | % | (2.2)% | 4.8 | % | 2.8 | % | 3.2 | % | |||||

| Expense | 9.2 | % | 5.4 | % | 10.0 | % | 7.7 | % | 12.2 | % | ||||

| NOI | 5.3 | % | (6.9)% | 2.5 | % | 0.5 | % | (2.3)% | ||||||

| Nine Months Ended September 30, 2024 | ||||||||||||||

| North America | ||||||||||||||

| MH | RV | Marina | Total | UK | ||||||||||

| Revenue | 6.8 | % | (0.5)% | 5.7 | % | 4.2 | % | 5.8 | % | |||||

| Expense | 7.3 | % | 3.0 | % | 7.0 | % | 5.5 | % | 3.9 | % | ||||

| NOI | 6.6 | % | (3.2)% | 5.0 | % | 3.6 | % | 7.7 | % | |||||

| Number of Properties | 283 | 164 | 127 | 574 | 52 | |||||||||

North America Same Property adjusted blended occupancy for MH and RV increased by 160 basis points to 98.8% at September 30, 2024, from 97.2% at September 30, 2023.

INVESTMENT ACTIVITY

During the quarter ended September 30, 2024, the Company completed the following dispositions:

- In July, a portfolio of six MH properties across six states for total cash consideration of $224.6million, with a gain on sale of $142.0million.

- In July, one MH property for total cash consideration of $38.0million, with a gain on sale of $16.0million.

- In September, one MH property for total cash consideration of $38.0million, with a gain on sale of $22.2million.

- In September, two MH land parcels under development for total cash consideration of $37.2million.

Net proceeds from the dispositions were used to pay off an aggregate of $93.5 million of mortgage debt and $225.7 million of borrowings under the Company’s senior credit facility.

During the quarter ended September 30, 2024, the Company acquired one marina property and one marina expansion asset for total consideration of $51.8million, including $31.5 million in the form of common OP units.

Refer to page 14 for additional details related to the Company’s acquisition and disposition activity.

Impact of Hurricane Helene

On September 26, 2024, Hurricane Helene made landfall in Florida and subsequently affected the Mid-Atlantic region of the U.S. Preliminary assessments indicate that material damage to the Company’s properties was largely avoided. During the quarter ended September 30, 2024, the Company recognized charges of $2.2million for impaired assets at two MH communities and three RV communities, and charges of $1.7million for impaired assets at nine marinas. The impacted properties are located in Florida, South Carolina, North Carolina and Georgia.

The foregoing impairment is based on current information available, and the Company continues to assess these estimates. The actual final impairment could vary significantly from these estimates. Any changes to these estimates will be recognized in the period(s) in which they are determined.

Impact of Hurricane Milton

On October 9, 2024, Hurricane Milton made landfall in Florida and affected certain of the Company’s properties in the region. The Company responded quickly to the event and clean-up and restoration efforts are in progress.

The Company maintains property, casualty, flood, and business interruption insurance for its properties, subject to customary deductibles and limits.

BALANCE SHEET, CAPITAL MARKETS ACTIVITY AND OTHER ITEMS

As of September 30, 2024, the Company had $7.4 billion in debt outstanding with a weighted average interest rate of 4.1% and a weighted average maturity of 6.4 years. At September 30, 2024, the Company’s Net Debt to trailing twelve-month Recurring EBITDA ratio was 6.0 times and approximately 6.0% of its outstanding debt is floating rate.

Equity Transactions

During the quarter ended September 30, 2024, the Company entered into and settled all outstanding forward sale agreements with respect to 2,713,571 shares of common stock under its At the Market Offering Sales Agreement. Net proceeds of $361.7million from the settlement of these forward sale agreements were used to repay borrowings outstanding under the Company’s senior credit facility.

2024 GUIDANCE

The Company is updating full-year, and establishing fourth quarter 2024 guidance for diluted EPS and Core FFO per Share:

| Full-Year Ending December 31, 2024 | Fourth Quarter Ending December 31, 2024 | |||||||||||||||||||||||

| Prior FY Guidance | Revised FY Range | |||||||||||||||||||||||

| Reconciliation of Diluted EPS to Core FFO per Share | Low | High | Low | High | Low | High | ||||||||||||||||||

| Diluted EPS | $ | 2.92 | $ | 3.08 | $ | 2.73 | $ | 2.81 | $ | 0.21 | $ | 0.29 | ||||||||||||

| Depreciation and amortization | 5.53 | 5.53 | 5.46 | 5.46 | 1.29 | 1.29 | ||||||||||||||||||

| Gain on sale of assets | (0.26 | ) | (0.26 | ) | (0.21 | ) | (0.21 | ) | (0.05 | ) | (0.05 | ) | ||||||||||||

| Gain on sale of properties | (1.18 | ) | (1.18 | ) | (1.45 | ) | (1.45 | ) | — | — | ||||||||||||||

| Distributions on preferred OP units | 0.10 | 0.10 | 0.10 | 0.10 | 0.02 | 0.02 | ||||||||||||||||||

| Noncontrolling interest | 0.08 | 0.08 | 0.12 | 0.12 | 0.01 | 0.01 | ||||||||||||||||||

| Transaction costs and other non-recurring G&A expenses | 0.18 | 0.18 | 0.29 | 0.29 | 0.05 | 0.05 | ||||||||||||||||||

| Deferred tax benefit | (0.23 | ) | (0.23 | ) | (0.24 | ) | (0.24 | ) | (0.11 | ) | (0.11 | ) | ||||||||||||

| Difference in weighted average share count attributed to dilutive convertible securities | (0.14 | ) | (0.14 | ) | (0.13 | ) | (0.13 | ) | (0.01 | ) | (0.01 | ) | ||||||||||||

| Other adjustments(a) | 0.06 | 0.06 | 0.09 | 0.09 | (0.04 | ) | (0.04 | ) | ||||||||||||||||

| Core FFO(b)(c) per Share | $ | 7.06 | $ | 7.22 | $ | 6.76 | $ | 6.84 | $ | 1.37 | $ | 1.45 | ||||||||||||

(a) Other adjustments consist primarily of remeasurement (gains) / losses, contingent legal and insurance gains and other items presented in the table Reconciliation of Net Income / (Loss) Attributable to SUI Common Shareholders to Core FFO on page 6.

(b) The diluted share counts for the quarter and year ending December 31, 2024 are estimated to be 132.5 million and 130.4 million, respectively.

(c) The Company’s updated guidance translates forecasted results from operations in the UK using the relevant exchange rate in effect provided in the table presented below. The impact of fluctuations in Canadian and Australian foreign currency rates on revised and initial guidance are not material.

| Exchange Rates in Effect at: | December 31, 2023 | June 30, 2024 | September 30, 2024 | |||

| U.S. Dollar (“USD”) / Pound Sterling (“GBP”) | 1.27 | 1.26 | 1.34 | |||

| USD / Canadian Dollar (“CAD”) | 0.75 | 0.73 | 0.74 | |||

| USD / Australian Dollar (“AUD”) | 0.68 | 0.67 | 0.69 |

The Company’s updated guidance for the full-year ending December 31, 2024 is reflected below. Note that certain prior period amounts have been reclassified to conform with current period presentation, with no effect on Net income / (loss) and Core FFO. The reclassifications more precisely align certain indirect expenses with underlying activity drivers.

Key adjustments versus prior guidance are:

- Total Real Property NOI growth is 3.5% – 3.9%, 240 basis points lower at the midpoint of guidance for 2024, primarily reflecting year-to-date property dispositions and the resultant loss of income from those properties, increased costs versus an anticipated reduction in costs and expense savings incorporated into previous guidance, and lower expected transient revenue in our RV and marina businesses.

- Interest expense – lowering full-year interest expense guidance by $2.0 million at the midpoint, primarily due to reduced debt balances, partially offset by GBP to USD foreign currency exchange movement.

- Same Property Portfolio

- In North America, the Company is reducing the midpoint for Same Property NOI growth for the full-year to approximately 3.0%.

- MH – reducing Same Property NOI growth to a range of 5.6% – 6.2%, a decrease of 120 basis points at the midpoint, reflecting higher operating expenses than anticipated in prior guidance, primarily in supplies and repairs and utilities.

- RV – reducing Same Property NOI growth to a range of (5.3%) – (4.1%), a decrease of 480 basis points at the midpoint, reflecting ongoing headwinds in the transient RV segment, particularly in September including storm-related disruption, and higher operating expenses than anticipated in prior guidance, primarily in supplies and repairs and utilities.

- Marinas – reducing Same Property NOI to a range of 4.4% – 5.2%, a decrease of 190 basis points at the midpoint, reflecting delayed returns of large vessels to the US from Europe, in part due to weather, lower overall occupancy and higher expenses than originally expected, primarily in payroll.

- In the UK, the Company is reducing Same Property NOI growth to a range of 7.1% – 8.7% for the full-year, a decrease of 160 basis points at the midpoint, primarily due to the move-in timing of new owners and higher expenses in supplies and repairs and payroll.

- Full-year 2023 and year-to-date 2024 actual results have been adjusted for property dispositions in the 2024 Same Property Portfolio guidance for comparative performance purposes.

- In North America, the Company is reducing the midpoint for Same Property NOI growth for the full-year to approximately 3.0%.

- Service, retail, dining and entertainment NOI – lowering full-year service, retail, dining and entertainment NOI by $11.9 million at the midpoint due to lower transient demand in RV and Marinas leading to less revenue generation from ancillary service, retail, dining, entertainment and fuel sales and therefore lower resultant NOI.

- FFO contribution from US home sales – lowering full-year North American home sales FFO contribution by $3.7 million at the midpoint due to lower home sale volume expectations in the fourth quarter, following September home sales that fell short of internal expectations after July and August finished ahead of internal expectations. Volumes particularly impacted in the Southeast and Florida, in large part due to the hurricanes.

- General and administrative expenses, excluding non-recurring expenses – increasing the midpoint by approximately $1.9 million, or 75 basis points, reflecting primarily payroll-related corporate cost increases.

- Current tax expense – lowering the midpoint by $9.5 million due to lower UK taxes than anticipated and higher than expected GBP to USD foreign currency exchange rates.

Supplemental Guidance Tables:

| Same Property Portfolio (in millions and %)(a) | FY 2023 Actual Results | Expected Change in 2024 | |||||||||||||

| Prior FY Range | November6, 2024 Update | ||||||||||||||

| North America | |||||||||||||||

| Revenues from real property | $ | 1,702.4 | 4.8 | % | – | 5.2 | % | 4.2 | % | – | 4.5 | % | |||

| Total property operating expenses | $ | 572.6 | 4.0 | % | – | 4.8 | % | 6.9 | % | – | 7.3 | % | |||

| Total North America Same Property NOI(b)(c) | $ | 1,129.8 | 4.7 | % | – | 5.7 | % | 2.6 | % | – | 3.3 | % | |||

| MH NOI (283 properties) | $ | 591.7 | 6.8 | % | – | 7.4 | % | 5.6 | % | – | 6.2 | % | |||

| RV NOI (163 properties) | $ | 285.4 | (0.7 | %) | – | 0.9 | % | (5.3 | %) | – | (4.1 | %) | |||

| Marina NOI (127 properties) | $ | 252.7 | 6.2 | % | – | 7.2 | % | 4.4 | % | – | 5.2 | % | |||

| UK (52 properties) | |||||||||||||||

| Revenues from real property | $ | 140.6 | 6.7 | % | – | 7.2 | % | 5.5 | % | – | 6.1 | % | |||

| Total property operating expenses | $ | 69.7 | 3.9 | % | – | 4.7 | % | 3.4 | % | – | 3.9 | % | |||

| Total UK Same Property NOI(b) | $ | 70.9 | 8.6 | % | – | 10.4 | % | 7.1 | % | – | 8.7 | % | |||

For the fourth quarter ending December 31, 2024, the Company’s guidance range assumes North America Same Property NOI growth of (0.8%) – 2.5% and UK Same Property NOI growth of 5.3% – 12.6%.

| Consolidated Portfolio Guidance For 2024 (in millions and %) | FY 2023 Actual Results | Expected Change / Range in 2024 | |||||||||||||||||

| Prior FY Range | November6, 2024 Update | ||||||||||||||||||

| Revenues from real property | $ | 2,059.8 | 5.3 | % | – | 5.5 | % | 4.8 | % | – | 5.0 | % | |||||||

| Total property operating expenses | $ | 810.4 | 4.1 | % | – | 4.4 | % | 6.6 | % | – | 6.9 | % | |||||||

| Total Real Property NOI | $ | 1,249.4 | 5.8 | % | – | 6.4 | % | 3.5 | % | – | 3.9 | % | |||||||

| Service, retail, dining and entertainment NOI | $ | 68.5 | $ | 63.0 | – | $ | 67.0 | $ | 51.6 | – | $ | 54.5 | |||||||

| Interest income | $ | 45.4 | $ | 17.8 | – | $ | 18.8 | $ | 19.6 | – | $ | 20.4 | |||||||

| Brokerage commissions and other, net(d)(e) | $ | 60.6 | $ | 37.6 | – | $ | 39.6 | $ | 37.6 | – | $ | 39.6 | |||||||

| FFO contribution from North American home sales | $ | 17.0 | $ | 13.0 | – | $ | 13.9 | $ | 9.5 | – | $ | 10.1 | |||||||

| FFO contribution from UK home sales(f) | $ | 59.2 | $ | 55.1 | – | $ | 61.0 | $ | 55.1 | – | $ | 61.0 | |||||||

| Income from nonconsolidated affiliates | $ | 16.0 | $ | 11.1 | – | $ | 11.9 | $ | 9.2 | – | $ | 9.7 | |||||||

| General and administrative expenses | $ | 272.1 | $ | 268.7 | – | $ | 272.0 | $ | 285.3 | – | $ | 287.4 | |||||||

| General and administrative expenses excluding non-recurring expenses | $ | 242.5 | $ | 247.0 | – | $ | 250.3 | $ | 249.5 | – | $ | 251.6 | |||||||

| Interest expense | $ | 325.8 | $ | 350.1 | – | $ | 353.6 | $ | 348.6 | – | $ | 351.2 | |||||||

| Current tax expense | $ | 14.5 | $ | 12.7 | – | $ | 13.7 | $ | 3.4 | – | $ | 4.0 | |||||||

| Expected Range in FY 2024 |

| Seasonality | 1Q24 | 2Q24 | 3Q24 | 4Q24 | ||||||||

| North America Same Property NOI: | ||||||||||||

| MH | 25 | % | 25 | % | 25 | % | 25 | % | ||||

| RV | 18 | % | 26 | % | 40 | % | 16 | % | ||||

| Marina | 19 | % | 27 | % | 30 | % | 24 | % | ||||

| Total | 22 | % | 25 | % | 30 | % | 23 | % | ||||

| UK Same Property NOI | 14 | % | 26 | % | 38 | % | 22 | % | ||||

| Home Sales FFO | ||||||||||||

| North America | 13 | % | 53 | % | 23 | % | 11 | % | ||||

| UK | 17 | % | 27 | % | 35 | % | 21 | % | ||||

| Consolidated Service, Retail, Dining and Entertainment NOI | 4 | % | 41 | % | 42 | % | 13 | % | ||||

| Consolidated EBITDA | 19 | % | 28 | % | 31 | % | 22 | % | ||||

| Core FFO per Share | 18 | % | 27 | % | 34 | % | 21 | % | ||||

Preliminary 2025 Rental Rate Increase

The Company expects to realize the following rental rate increases, on average, during 2025:

| Average 2025 Rental Rate Increases Expected | ||

| North America | ||

| MH | 5.2 | % |

| Annual RV | 5.1 | % |

| Marina | 3.7 | % |

| UK | 3.7 | % |

| Footnotes to 2024 Guidance Assumptions | |||||

| (a) | The amounts in the Same Property Portfolio table reflect constant currency, as Canadian dollar and pound sterling figures included within the 2023 amounts have been translated at the assumed exchange rates used for 2024 guidance. | ||||

| (b) | Total North America Same Property results net $110.8 million and $113.5 million of utility revenue against the related utility expense in property operating expenses for 2023 results and 2024 guidance, respectively. Total UK Same Property results net $17.1 million and $18.3 million of utility revenue against the related utility expense in property operating expenses for 2023 results and 2024 guidance, respectively. | ||||

| (c) | 2023 North America Same Property actual results exclude $0.4 million of expenses incurred at recently acquired properties to bring them up to the Company’s standards. The improvements included items such as tree trimming and painting costs that do not meet the Company’s capitalization policy. | ||||

| (d) | Brokerage commissions and other, net includes $23.4 million and $17.8 million of business interruption income for the full-year 2023 results and 2024 guidance, respectively. Business interruption recovery income for the first through third quarters of 2024 in the amount of $16.4 million was recorded as an adjustment to Core FFO in the loss of earnings – Catastrophic event-related charges, net line item. | ||||

| (e) | Brokerage commissions and other, net included approximately $8.5 million of lease income in 2023 that will be recognized in total real property NOI in 2024. | ||||

| (f) | Includes UK home sales from Park Holidays and Sandy Bay. | ||||

The estimates and assumptions presented above represent a range of possible outcomes and may differ materially from actual results. These estimates include contributions from all acquisitions, dispositions and capital markets activity completed through November6, 2024. These estimates exclude all other prospective acquisitions, dispositions and capital markets activity. The estimates and assumptions are forward-looking based on the Company’s current assessment of economic and market conditions and are subject to the other risks outlined below under the caption Cautionary Statement Regarding Forward-Looking Statements.

EARNINGS CONFERENCE CALL

A conference call to discuss third quarter results will be held on Wednesday, November6, 2024 at 5:00 P.M. (ET). To participate, call toll-free at (800) 245-3047. Callers outside the U.S. or Canada can access the call at (203) 518-9765. A replay will be available following the call through November20, 2024 and can be accessed toll-free by calling (844) 512-2921 or (412) 317-6671. The Conference ID for the call is “SUIQ3”. The Conference ID number for the call and the replay is 11157495. The conference call will be available live on the Company’s website located at www.suninc.com. The replay will also be available on the website.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this document that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intend,” “goal,” “estimate,” “expect,” “project,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “scheduled,” “guidance,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements reflect the Company’s current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this document, some of which are beyond the Company’s control. These risks and uncertainties and other factors may cause the Company’s actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks described under “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s other filings with the Securities and Exchange Commission, from time to time, such risks, uncertainties and other factors include, but are not limited to:

| ∙ | Changes in general economic conditions, including inflation, deflation, energy costs, the real estate industry and the markets within which the Company operates; |

| ∙ | Difficulties in the Company’s ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; |

| ∙ | The Company’s liquidity and refinancing demands; |

| ∙ | The Company’s ability to obtain or refinance maturing debt; |

| ∙ | The Company’s ability to maintain compliance with covenants contained in its debt facilities and its unsecured notes; |

| ∙ | Availability of capital; |

| ∙ | Outbreaks of disease and related restrictions on business operations; |

| ∙ | Changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian dollar, Australian dollar and pound sterling; |

| ∙ | The Company’s ability to maintain rental rates and occupancy levels; |

| ∙ | The Company’s ability to maintain effective internal control over financial reporting and disclosure controls and procedures; |

| ∙ | The Company’s remediation plan and its ability to remediate the material weaknesses in its internal control over financial reporting; |

| ∙ | Expectations regarding the amount or frequency of impairment losses, including as a result of the write-down of intangible assets, including goodwill; |

| ∙ | Increases in interest rates and operating costs, including insurance premiums and real estate taxes; |

| ∙ | Risks related to natural disasters such as hurricanes, earthquakes, floods, droughts and wildfires; |

| ∙ | General volatility of the capital markets and the market price of shares of the Company’s capital stock; |

| ∙ | The Company’s ability to maintain its status as a REIT; |

| ∙ | Changes in real estate and zoning laws and regulations; |

| ∙ | Legislative or regulatory changes, including changes to laws governing the taxation of REITs; |

| ∙ | Litigation, judgments or settlements, including costs associated with prosecuting or defending claims and any adverse outcomes; |

| ∙ | Competitive market forces; |

| ∙ | The ability of purchasers of manufactured homes and boats to obtain financing; and |

| ∙ | The level of repossessions by manufactured home and boat lenders; |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included or incorporated by reference into this document, whether as a result of new information, future events, changes in the Company’s expectations or otherwise, except as required by law.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by these cautionary statements.

Company Overview and Investor Information

The Company

Established in 1975, Sun Communities, Inc. became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of September 30, 2024, the Company owned, operated, or had an interest in a portfolio of 659 developed MH, RV, Marina, and UK properties comprising approximately 179,130 developed sites and approximately 48,760 wet slips and dry storage spaces in the U.S., Canada and the U.K.

For more information about the Company, please visit www.suninc.com.

| Company Contacts | |

| Investor Relations | |

| Sara Ismail, Vice President | |

| (248) 208-2500 | |

| investorrelations@suncommunities.com | |

| Corporate Debt Ratings | |

| Moody’s | S&P |

| Baa3 | Stable | BBB | Stable |

| Equity Research Coverage | ||||

| Bank of America Merrill Lynch | Joshua Dennerlein | joshua.dennerlein@bofa.com | ||

| BMO Capital Markets | John Kim | jp.kim@bmo.com | ||

| Citi Research | Eric Wolfe | eric.wolfe@citi.com | ||

| Nicholas Joseph | nicholas.joseph@citi.com | |||

| Deutsche Bank | Conor Peaks | conor.peaks@db.com | ||

| Omotayo Okusanya | omotayo.okusanya@db.com | |||

| Evercore ISI | Samir Khanal | samir.khanal@evercoreisi.com | ||

| Steve Sakwa | steve.sakwa@evercoreisi.com | |||

| Green Street Advisors | John Pawlowski | jpawlowski@greenstreet.com | ||

| Jefferies LLC | Peter Abramowitz | pabramowitz@jefferies.com | ||

| JMP Securities | Aaron Hecht | ahecht@jmpsecurities.com | ||

| RBC Capital Markets | Brad Heffern | brad.heffern@rbccm.com | ||

| Robert W. Baird & Co. | Wesley Golladay | wgolladay@rwbaird.com | ||

| Truist Securities | Anthony Hau | anthony.hau@truist.com | ||

| UBS | Michael Goldsmith | michael.goldsmith@ubs.com | ||

| Wells Fargo | James Feldman | james.feldman@wellsfargo.com | ||

| Wolfe Research | Andrew Rosivach | arosivach@wolferesearch.com | ||

| Keegan Carl | kcarl@wolferesearch.com |

Financial and Operating Highlights

($ in millions, except Per Share amounts)

| Quarters Ended | |||||||||||||||||||

| 9/30/2024 | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023(a) | |||||||||||||||

| Financial Information | |||||||||||||||||||

| Basic earnings / (loss) per share | $ | 2.31 | $ | 0.42 | $ | (0.22 | ) | $ | (0.65 | ) | $ | 0.97 | |||||||

| Diluted earnings / (loss) per share | $ | 2.31 | $ | 0.42 | $ | (0.22 | ) | $ | (0.65 | ) | $ | 0.97 | |||||||

| Cash distributions declared per common share | $ | 0.94 | $ | 0.94 | $ | 0.94 | $ | 0.93 | $ | 0.93 | |||||||||

| FFO per Share(b)(c) | $ | 2.19 | $ | 1.79 | $ | 1.12 | $ | 1.41 | $ | 2.55 | |||||||||

| Core FFO per Share(b)(c) | $ | 2.34 | $ | 1.86 | $ | 1.19 | $ | 1.34 | $ | 2.57 | |||||||||

| Real Property NOI(b) | |||||||||||||||||||

| MH | $ | 158.3 | $ | 160.7 | $ | 162.5 | $ | 155.6 | $ | 153.1 | |||||||||

| RV | 117.0 | 74.2 | 51.2 | 50.4 | 128.2 | ||||||||||||||

| Marina | 85.1 | 77.7 | 56.9 | 65.3 | 83.1 | ||||||||||||||

| UK | 28.8 | 18.7 | 15.3 | 14.0 | 29.0 | ||||||||||||||

| Total | $ | 389.2 | $ | 331.3 | $ | 285.9 | $ | 285.3 | $ | 393.4 | |||||||||

| Recurring EBITDA(b) | $ | 382.6 | $ | 335.9 | $ | 234.0 | $ | 256.0 | $ | 433.0 | |||||||||

| TTM Recurring EBITDA / Interest(b) | 3.4 x | 3.6 x | 3.7 x | 3.9 x | 4.0 x | ||||||||||||||

| Net Debt / TTM Recurring EBITDA(b) | 6.0 x | 6.2 x | 6.1 x | 6.1 x | 6.1 x | ||||||||||||||

| Balance Sheet | |||||||||||||||||||

| Total assets | $ | 17,085.1 | $ | 17,011.1 | $ | 17,113.3 | $ | 16,940.7 | $ | 17,246.6 | |||||||||

| Total debt | $ | 7,324.8 | $ | 7,852.8 | $ | 7,872.0 | $ | 7,777.3 | $ | 7,665.0 | |||||||||

| Total liabilities | $ | 9,245.7 | $ | 9,781.6 | $ | 9,830.0 | $ | 9,506.8 | $ | 9,465.0 | |||||||||

| Operating Information | |||||||||||||||||||

| Properties | |||||||||||||||||||

| MH | 288 | 296 | 296 | 298 | 298 | ||||||||||||||

| RV | 179 | 179 | 179 | 179 | 182 | ||||||||||||||

| Marina | 138 | 137 | 136 | 135 | 135 | ||||||||||||||

| UK | 54 | 54 | 54 | 55 | 55 | ||||||||||||||

| Total | 659 | 666 | 665 | 667 | 670 | ||||||||||||||

| Sites, Wet Slips and Dry Storage Spaces | |||||||||||||||||||

| MH | 97,300 | 100,160 | 99,930 | 100,320 | 100,200 | ||||||||||||||

| Annual RV | 34,480 | 33,590 | 33,290 | 32,390 | 32,150 | ||||||||||||||

| Transient | 25,060 | 25,720 | 25,560 | 25,290 | 26,490 | ||||||||||||||

| UK annual | 17,790 | 17,710 | 18,110 | 18,110 | 18,050 | ||||||||||||||

| UK transient | 4,500 | 4,580 | 3,220 | 3,200 | 3,280 | ||||||||||||||

| Total sites | 179,130 | 181,760 | 180,110 | 179,310 | 180,170 | ||||||||||||||

| Marina wet slips and dry storage spaces(d) | 48,760 | 48,140 | 48,040 | 48,030 | 48,030 | ||||||||||||||

| Occupancy | |||||||||||||||||||

| MH | 96.9 | % | 96.7 | % | 96.7 | % | 96.6 | % | 96.3 | % | |||||||||

| Annual RV | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||

| Blended MH and annual RV | 97.7 | % | 97.5 | % | 97.5 | % | 97.4 | % | 97.2 | % | |||||||||

| UK annual | 91.5 | % | 89.9 | % | 88.9 | % | 89.5 | % | 90.6 | % | |||||||||

| MH and RV Revenue Producing Site Net Gains(e) | |||||||||||||||||||

| MH leased sites, net | 159 | 315 | 57 | 387 | 207 | ||||||||||||||

| RV leased sites, net | 893 | 918 | 157 | 296 | 537 | ||||||||||||||

| Total leased sites, net | 1,052 | 1,233 | 214 | 683 | 744 | ||||||||||||||

(a) Reflects restated financial information for non-cash goodwill impairment charges.

(b) Refer to Definition and Notes for additional information.

(c) Excludes the effect of certain anti-dilutive convertible securities.

(d) Total wet slips and dry storage spaces are adjusted each quarter based on site configuration and usability.

(e) Revenue producing site net gains do not include occupied sites acquired during the year.

Portfolio Overview as of September 30, 2024

| MH & RV Properties | |||||||||||||

| Properties | MH & Annual RV | Transient RV Sites | Total Sites | Sites for Development | |||||||||

| Location | Sites | Occupancy % | |||||||||||

| North America | |||||||||||||

| Florida | 127 | 41,190 | 97.9 | % | 3,950 | 45,140 | 2,330 | ||||||

| Michigan | 85 | 33,020 | 97.3 | % | 510 | 33,530 | 1,290 | ||||||

| California | 37 | 6,970 | 99.1 | % | 1,870 | 8,840 | 570 | ||||||

| Texas | 29 | 9,170 | 96.4 | % | 1,750 | 10,920 | 3,850 | ||||||

| Ontario, Canada | 16 | 4,710 | 100.0 | % | 470 | 5,180 | 1,450 | ||||||

| Connecticut | 16 | 1,920 | 95.5 | % | 90 | 2,010 | — | ||||||

| Maine | 15 | 2,560 | 96.8 | % | 980 | 3,540 | 200 | ||||||

| Arizona | 11 | 4,190 | 97.3 | % | 810 | 5,000 | 1,120 | ||||||

| Indiana | 11 | 2,940 | 98.9 | % | 1,020 | 3,960 | 180 | ||||||

| New Jersey | 11 | 3,070 | 100.0 | % | 920 | 3,990 | 260 | ||||||

| Colorado | 11 | 2,920 | 89.0 | % | 960 | 3,880 | 1,390 | ||||||

| Virginia | 10 | 1,670 | 99.9 | % | 2,040 | 3,710 | 750 | ||||||

| New York | 10 | 1,550 | 98.8 | % | 1,630 | 3,180 | 780 | ||||||

| Other | 78 | 15,900 | 99.0 | % | 8,060 | 23,960 | 1,000 | ||||||

| Total | 467 | 131,780 | 97.7 | % | 25,060 | 156,840 | 15,170 | ||||||

| Properties | UK Properties | Transient Sites | Total Sites | Sites for Development | |||||||||

| Location | Sites | Occupancy % | |||||||||||

| United Kingdom | 54 | 17,790 | 91.5 | % | 4,500 | 22,290 | 3,020 | ||||||

| Marina | ||||||||

| Properties | Wet Slips and Dry Storage Spaces | |||||||

| Location | ||||||||

| Florida | 21 | 5,060 | ||||||

| Rhode Island | 12 | 3,460 | ||||||

| Connecticut | 12 | 3,580 | ||||||

| California | 12 | 6,440 | ||||||

| New York | 9 | 2,970 | ||||||

| Massachusetts | 9 | 2,540 | ||||||

| Maryland | 9 | 2,400 | ||||||

| Other | 54 | 22,310 | ||||||

| Total | 138 | 48,760 | ||||||

| Properties | Sites, Wet Slips and Dry Storage Spaces | |||||||

| Total Portfolio | 659 | 227,890 |

Consolidated Balance Sheets

(amounts in millions)

| September 30, 2024 | December 31, 2023 | ||||||

| Assets | (Unaudited) | ||||||

| Land | $ | 4,646.2 | $ | 4,278.2 | |||

| Land improvements and buildings | 11,608.6 | 11,682.2 | |||||

| Rental homes and improvements | 782.2 | 744.4 | |||||

| Furniture, fixtures and equipment | 1,090.2 | 1,011.7 | |||||

| Investment property | 18,127.2 | 17,716.5 | |||||

| Accumulated depreciation | (3,635.7 | ) | (3,272.9 | ) | |||

| Investment property, net | 14,491.5 | 14,443.6 | |||||

| Cash, cash equivalents and restricted cash | 81.8 | 42.7 | |||||

| Inventory of manufactured homes | 174.8 | 205.6 | |||||

| Notes and other receivables, net | 494.4 | 421.6 | |||||

| Collateralized receivables, net(a) | 52.8 | 56.2 | |||||

| Goodwill | 742.6 | 733.0 | |||||

| Other intangible assets, net | 350.7 | 369.5 | |||||

| Other assets, net | 696.5 | 668.5 | |||||

| Total Assets | $ | 17,085.1 | $ | 16,940.7 | |||

| Liabilities | |||||||

| Mortgage loans payable | $ | 3,344.5 | $ | 3,478.9 | |||

| Secured borrowings on collateralized receivables(a) | 52.8 | 55.8 | |||||

| Unsecured debt | 3,927.5 | 4,242.6 | |||||

| Distributions payable | 122.3 | 118.2 | |||||

| Advanced reservation deposits and rent | 382.4 | 344.5 | |||||

| Accrued expenses and accounts payable | 390.9 | 313.7 | |||||

| Other liabilities | 1,025.3 | 953.1 | |||||

| Total Liabilities | 9,245.7 | 9,506.8 | |||||

| Commitments and contingencies | |||||||

| Temporary equity | 263.3 | 260.9 | |||||

| Shareholders’ Equity | |||||||

| Common stock | 1.3 | 1.2 | |||||

| Additional paid-in capital | 9,853.6 | 9,466.9 | |||||

| Accumulated other comprehensive income | 33.9 | 12.2 | |||||

| Distributions in excess of accumulated earnings | (2,433.3 | ) | (2,397.5 | ) | |||

| Total SUI Shareholders’ Equity | 7,455.5 | 7,082.8 | |||||

| Noncontrolling interests | |||||||

| Common and preferred OP units | 119.8 | 90.2 | |||||

| Consolidated entities | 0.8 | — | |||||

| Total noncontrolling interests | 120.6 | 90.2 | |||||

| Total Shareholders’ Equity | 7,576.1 | 7,173.0 | |||||

| Total Liabilities, Temporary Equity and Shareholders’ Equity | $ | 17,085.1 | $ | 16,940.7 | |||

(a) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

Consolidated Statements of Operations

(amounts in millions, except for per share amounts, unaudited)

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||

| September 30, 2024 | September 30, 2023 | % Change | September 30, 2024 | September 30, 2023 | % Change | ||||||||||||||||

| Revenues | As Restated | As Restated | |||||||||||||||||||

| Real property (excluding transient)(a) | $ | 485.7 | $ | 457.2 | 6.2 | % | $ | 1,383.4 | $ | 1,285.5 | 7.6 | % | |||||||||

| Real property – transient | 148.4 | 161.6 | (8.2)% | 279.0 | 300.9 | (7.3)% | |||||||||||||||

| Home sales | 105.3 | 117.8 | (10.6)% | 281.7 | 326.7 | (13.8)% | |||||||||||||||

| Service, retail, dining and entertainment | 186.2 | 205.5 | (9.4)% | 492.7 | 498.9 | (1.2)% | |||||||||||||||

| Interest | 5.5 | 15.2 | (63.8)% | 15.4 | 40.6 | (62.1)% | |||||||||||||||

| Brokerage commissions and other, net | 8.8 | 26.0 | (66.2)% | 23.0 | 45.3 | (49.2)% | |||||||||||||||

| Total Revenues | 939.9 | 983.3 | (4.4)% | 2,475.2 | 2,497.9 | (0.9)% | |||||||||||||||

| Expenses | |||||||||||||||||||||

| Property operating and maintenance(a) | 213.4 | 196.1 | 8.8 | % | 561.8 | 532.9 | 5.4 | % | |||||||||||||

| Real estate tax | 31.5 | 29.3 | 7.5 | % | 94.2 | 89.4 | 5.4 | % | |||||||||||||

| Home costs and selling | 74.3 | 84.5 | (12.1)% | 203.0 | 233.5 | (13.1)% | |||||||||||||||

| Service, retail, dining and entertainment | 163.3 | 173.4 | (5.8)% | 445.1 | 438.2 | 1.6 | % | ||||||||||||||

| General and administrative | 74.8 | 67.0 | 11.6 | % | 218.6 | 193.8 | 12.8 | % | |||||||||||||

| Catastrophic event-related charges, net | 0.9 | (3.1 | ) | N/M | 10.4 | (2.2 | ) | N/M | |||||||||||||

| Business combinations | 0.2 | — | N/A | 0.4 | 3.0 | (86.7)% | |||||||||||||||

| Depreciation and amortization | 172.4 | 162.6 | 6.0 | % | 510.5 | 482.3 | 5.8 | % | |||||||||||||

| Asset impairments | 0.2 | 1.2 | (83.3)% | 32.5 | 10.1 | 221.8 | % | ||||||||||||||

| Goodwill impairment | — | 44.8 | (100.0)% | — | 369.9 | (100.0)% | |||||||||||||||

| Loss on extinguishment of debt | 0.8 | — | N/A | 1.4 | — | N/A | |||||||||||||||

| Interest | 87.7 | 84.1 | 4.3 | % | 267.2 | 239.9 | 11.4 | % | |||||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | — | 0.8 | (100.0)% | — | 2.7 | (100.0)% | |||||||||||||||

| Total Expenses | 819.5 | 840.7 | (2.5)% | 2,345.1 | 2,593.5 | (9.6)% | |||||||||||||||

| Income / (Loss) Before Other Items | 120.4 | 142.6 | (15.6)% | 130.1 | (95.6 | ) | N/M | ||||||||||||||

| Gain / (loss) on remeasurement of marketable securities | — | 6.1 | (100.0)% | — | (8.0 | ) | (100.0)% | ||||||||||||||

| Loss on foreign currency exchanges | (4.5 | ) | (6.5 | ) | (30.8)% | (6.2 | ) | (6.5 | ) | (4.6)% | |||||||||||

| Gain / (loss) on dispositions of properties | 178.7 | (0.7 | ) | N/M | 186.6 | (2.9 | ) | N/M | |||||||||||||

| Other income / (expense), net(b) | (0.8 | ) | (3.7 | ) | (78.4)% | 5.6 | (5.5 | ) | N/M | ||||||||||||

| Gain / (loss) on remeasurement of notes receivable | 0.1 | (1.3 | ) | N/M | (1.0 | ) | (3.1 | ) | (67.7)% | ||||||||||||

| Income from nonconsolidated affiliates | 2.1 | 1.4 | 50.0 | % | 6.5 | 0.5 | N/M | ||||||||||||||

| Gain / (loss) on remeasurement of investment in nonconsolidated affiliates | 1.2 | — | N/A | 6.5 | (4.5 | ) | N/M | ||||||||||||||

| Current tax benefit / (expense) | 0.9 | (4.6 | ) | N/M | (6.5 | ) | (13.9 | ) | (53.2)% | ||||||||||||

| Deferred tax benefit | 7.1 | 2.3 | 208.7 | % | 16.5 | 14.6 | 13.0 | % | |||||||||||||

| Net Income / (Loss) | 305.2 | 135.6 | 125.1 | % | 338.1 | (124.9 | ) | N/M | |||||||||||||

| Less: Preferred return to preferred OP units / equity interests | 3.2 | 3.4 | (5.9)% | 9.6 | 9.0 | 6.7 | % | ||||||||||||||

| Less: Income / (loss) attributable to noncontrolling interests | 13.3 | 12.1 | 9.9 | % | 15.1 | (1.5 | ) | N/M | |||||||||||||

| Net Income / (Loss) Attributable to SUI Common Shareholders | $ | 288.7 | $ | 120.1 | 140.4 | % | $ | 313.4 | $ | (132.4 | ) | N/M | |||||||||

| Weighted average common shares outstanding – basic(b) | 124.0 | 123.5 | 0.4 | % | 123.8 | 123.4 | 0.3 | % | |||||||||||||

| Weighted average common shares outstanding – diluted(b) | 124.0 | 123.5 | 0.4 | % | 126.5 | 123.8 | 2.2 | % | |||||||||||||

| Basic earnings / (loss) per share | $ | 2.31 | $ | 0.97 | 138.1 | % | $ | 2.52 | $ | (1.06 | ) | N/M | |||||||||

| Diluted earnings / (loss) per share(c) | $ | 2.31 | $ | 0.97 | 138.1 | % | $ | 2.51 | $ | (1.07 | ) | N/M | |||||||||

(a) Refer to “Utility Revenues” within Definitions and Notes for additional information.

(b) Refer to Definitions and Notes for additional information.

(c) Excludes the effect of certain anti-dilutive convertible securities.

N/M = Not meaningful.

N/A = Not applicable.

Reconciliation of Net Income / (Loss) Attributable to SUI Common Shareholders to Core FFO

(amounts in millions, except for per share data)

| Quarter Ended | Nine Months Ended | ||||||||||||||

| September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | ||||||||||||

| As Restated | As Restated | ||||||||||||||

| Net Income / (Loss) Attributable to SUI Common Shareholders | $ | 288.7 | $ | 120.1 | $ | 313.4 | $ | (132.4 | ) | ||||||

| Adjustments | |||||||||||||||

| Depreciation and amortization | 171.6 | 162.2 | 508.1 | 480.5 | |||||||||||

| Depreciation on nonconsolidated affiliates | 0.1 | 0.1 | 0.3 | 0.2 | |||||||||||

| Asset impairments | 0.2 | 1.2 | 32.5 | 10.1 | |||||||||||

| Goodwill impairment | — | 44.8 | — | 369.9 | |||||||||||

| (Gain) / loss on remeasurement of marketable securities | — | (6.1 | ) | — | 8.0 | ||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | (1.2 | ) | — | (6.5 | ) | 4.5 | |||||||||

| (Gain) / loss on remeasurement of notes receivable | (0.1 | ) | 1.3 | 1.0 | 3.1 | ||||||||||

| (Gain) / loss on dispositions of properties, including tax effect | (181.4 | ) | 0.7 | (188.5 | ) | 5.0 | |||||||||

| Add: Returns on preferred OP units | — | 2.3 | 1.0 | 8.7 | |||||||||||

| Add: Income / (loss) attributable to noncontrolling interests | 1.1 | 11.5 | 10.1 | (1.5 | ) | ||||||||||

| Gain on disposition of assets, net | (7.1 | ) | (10.5 | ) | (21.1 | ) | (29.0 | ) | |||||||

| FFO(a) | $ | 271.9 | $ | 327.6 | $ | 650.3 | $ | 727.1 | |||||||

| Adjustments | |||||||||||||||

| Business combination expense | 0.2 | — | 0.4 | 3.0 | |||||||||||

| Acquisition and other transaction costs(a) | 2.9 | 4.2 | 15.9 | 12.6 | |||||||||||

| Loss on extinguishment of debt | 0.8 | — | 1.4 | — | |||||||||||

| Catastrophic event-related charges, net | 0.9 | (3.1 | ) | 10.4 | (2.2 | ) | |||||||||

| Loss of earnings – catastrophic event-related charges, net(b) | 5.9 | (6.1 | ) | 11.5 | 4.9 | ||||||||||

| Loss on foreign currency exchanges | 4.5 | 6.5 | 6.2 | 6.5 | |||||||||||

| Other adjustments, net(a) | 3.7 | 1.1 | (9.2 | ) | (9.6 | ) | |||||||||

| Core FFO(a)(c) | $ | 290.8 | $ | 330.2 | $ | 686.9 | $ | 742.3 | |||||||

| Weighted Average Common Shares Outstanding – Diluted | 124.2 | 128.4 | 127.3 | 128.8 | |||||||||||

| FFO per Share(a)(c) | $ | 2.19 | $ | 2.55 | $ | 5.11 | $ | 5.64 | |||||||

| Core FFO per Share(a)(c) | $ | 2.34 | $ | 2.57 | $ | 5.39 | $ | 5.76 | |||||||

(a) Refer to Definitions and Notes for additional information.

(b) Loss of earnings – catastrophic event-related charges, net include the following:

| Quarter Ended | Nine Months Ended | |||||||||||||

| September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | |||||||||||

| Hurricane Ian – three Fort Myers, Florida RV communities impaired | ||||||||||||||

| Estimated loss of earnings in excess of the applicable business interruption deductible | $ | 4.6 | $ | 6.3 | $ | 15.2 | $ | 16.8 | ||||||

| Insurance recoveries realized for previously estimated loss of earnings | — | (11.8 | ) | (5.0 | ) | (11.8 | ) | |||||||

| Hurricane Irma – three Florida Keys communities impaired | ||||||||||||||

| Estimated loss of earnings in excess of the applicable business interruption deductible | — | — | — | 0.5 | ||||||||||

| Reversal of unpaid previously estimated loss of earnings that the Company does not expect to recover | — | (0.6 | ) | — | (0.6 | ) | ||||||||

| Flooding event – estimated loss of earnings at one New Hampshire RV community | 1.3 | — | 1.3 | — | ||||||||||

| Loss of earnings – catastrophic event-related charges, net | $ | 5.9 | $ | (6.1 | ) | $ | 11.5 | $ | 4.9 | |||||

(c) Excludes the effect of certain anti-dilutive convertible securities.

Reconciliation of Net Income / (Loss) Attributable to SUI Common Shareholders to NOI

(amounts in millions)

| Quarter Ended | Nine Months Ended | ||||||||||||||

| September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | ||||||||||||

| As Restated | As Restated | ||||||||||||||

| Net Income / (Loss) Attributable to SUI Common Shareholders | $ | 288.7 | $ | 120.1 | $ | 313.4 | $ | (132.4 | ) | ||||||

| Interest income | (5.5 | ) | (15.2 | ) | (15.4 | ) | (40.6 | ) | |||||||

| Brokerage commissions and other revenues, net | (8.8 | ) | (26.0 | ) | (23.0 | ) | (45.3 | ) | |||||||

| General and administrative | 74.8 | 67.0 | 218.6 | 193.8 | |||||||||||

| Catastrophic event-related charges, net | 0.9 | (3.1 | ) | 10.4 | (2.2 | ) | |||||||||

| Business combination expense | 0.2 | — | 0.4 | 3.0 | |||||||||||

| Depreciation and amortization | 172.4 | 162.6 | 510.5 | 482.3 | |||||||||||

| Asset impairments | 0.2 | 1.2 | 32.5 | 10.1 | |||||||||||

| Goodwill impairment | — | 44.8 | — | 369.9 | |||||||||||

| Loss on extinguishment of debt | 0.8 | — | 1.4 | — | |||||||||||

| Interest expense | 87.7 | 84.1 | 267.2 | 239.9 | |||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | — | 0.8 | — | 2.7 | |||||||||||

| (Gain) / loss on remeasurement of marketable securities | — | (6.1 | ) | — | 8.0 | ||||||||||

| Loss on foreign currency exchanges | 4.5 | 6.5 | 6.2 | 6.5 | |||||||||||

| (Gain) / loss on disposition of properties | (178.7 | ) | 0.7 | (186.6 | ) | 2.9 | |||||||||

| Other (income) / expense, net(a) | 0.8 | 3.7 | (5.6 | ) | 5.5 | ||||||||||

| (Gain) / loss on remeasurement of notes receivable | (0.1 | ) | 1.3 | 1.0 | 3.1 | ||||||||||

| Income from nonconsolidated affiliates | (2.1 | ) | (1.4 | ) | (6.5 | ) | (0.5 | ) | |||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | (1.2 | ) | — | (6.5 | ) | 4.5 | |||||||||

| Current tax (benefit) / expense | (0.9 | ) | 4.6 | 6.5 | 13.9 | ||||||||||

| Deferred tax benefit | (7.1 | ) | (2.3 | ) | (16.5 | ) | (14.6 | ) | |||||||

| Add: Preferred return to preferred OP units / equity interests | 3.2 | 3.4 | 9.6 | 9.0 | |||||||||||

| Add: Income / (loss) attributable to noncontrolling interests | 13.3 | 12.1 | 15.1 | (1.5 | ) | ||||||||||

| NOI | $ | 443.1 | $ | 458.8 | $ | 1,132.7 | $ | 1,118.0 | |||||||

| Quarter Ended | Nine Months Ended | ||||||||||

| September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | ||||||||

| As Restated | As Restated | ||||||||||

| Real property NOI(a) | $ | 389.2 | $ | 393.4 | $ | 1,006.4 | $ | 964.1 | |||

| Home sales NOI(a) | 31.0 | 33.3 | 78.7 | 93.2 | |||||||

| Service, retail, dining and entertainment NOI(a) | 22.9 | 32.1 | 47.6 | 60.7 | |||||||

| NOI | $ | 443.1 | $ | 458.8 | $ | 1,132.7 | $ | 1,118.0 | |||

(a) Refer to Definitions and Notes for additional information.

Reconciliation of Net Income / (Loss) Attributable to SUI Common Shareholders to Recurring EBITDA

(amounts in millions)

| Quarter Ended | Nine Months Ended | ||||||||||||||

| September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | ||||||||||||

| As Restated | As Restated | ||||||||||||||

| Net Income / (Loss) Attributable to SUI Common Shareholders | $ | 288.7 | $ | 120.1 | $ | 313.4 | $ | (132.4 | ) | ||||||

| Adjustments | |||||||||||||||

| Depreciation and amortization | 172.4 | 162.6 | 510.5 | 482.3 | |||||||||||

| Asset impairments | 0.2 | 1.2 | 32.5 | 10.1 | |||||||||||

| Goodwill impairment | — | 44.8 | — | 369.9 | |||||||||||

| Loss on extinguishment of debt | 0.8 | — | 1.4 | — | |||||||||||

| Interest expense | 87.7 | 84.1 | 267.2 | 239.9 | |||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | — | 0.8 | — | 2.7 | |||||||||||

| Current tax (benefit) / expense | (0.9 | ) | 4.6 | 6.5 | 13.9 | ||||||||||

| Deferred tax benefit | (7.1 | ) | (2.3 | ) | (16.5 | ) | (14.6 | ) | |||||||

| Income from nonconsolidated affiliates | (2.1 | ) | (1.4 | ) | (6.5 | ) | (0.5 | ) | |||||||

| Less: (Gain) / loss on dispositions of properties | (178.7 | ) | 0.7 | (186.6 | ) | 2.9 | |||||||||

| Less: Gain on dispositions of assets, net | (7.1 | ) | (10.5 | ) | (21.1 | ) | (29.0 | ) | |||||||

| EBITDAre(a) | $ | 353.9 | $ | 404.7 | $ | 900.8 | $ | 945.2 | |||||||

| Adjustments | |||||||||||||||

| Catastrophic event-related charges, net | 0.9 | (3.1 | ) | 10.4 | (2.2 | ) | |||||||||

| Business combination expense | 0.2 | — | 0.4 | 3.0 | |||||||||||

| (Gain) / loss on remeasurement of marketable securities | — | (6.1 | ) | — | 8.0 | ||||||||||

| Loss on foreign currency exchanges | 4.5 | 6.5 | 6.2 | 6.5 | |||||||||||

| Other (income) / expense, net(a) | 0.8 | 3.7 | (5.6 | ) | 5.5 | ||||||||||

| (Gain) / loss on remeasurement of notes receivable | (0.1 | ) | 1.3 | 1.0 | 3.1 | ||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | (1.2 | ) | — | (6.5 | ) | 4.5 | |||||||||

| Add: Preferred return to preferred OP units / equity interests | 3.2 | 3.4 | 9.6 | 9.0 | |||||||||||

| Add: Income / (loss) attributable to noncontrolling interests | 13.3 | 12.1 | 15.1 | (1.5 | ) | ||||||||||

| Add: Gain on dispositions of assets, net | 7.1 | 10.5 | 21.1 | 29.0 | |||||||||||

| Recurring EBITDA(a) | $ | 382.6 | $ | 433.0 | $ | 952.5 | $ | 1,010.1 | |||||||

(a) Refer to Definitions and Notes for additional information.

Real Property Operations – Total Portfolio

(amounts in millions, except statistical information)

| Quarter Ended September 30, 2024 | Quarter Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||||

| Financial Information | MH | RV | Marinas | UK | Total | MH | RV | Marinas | UK | Total | |||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||||

| Real property (excluding transient)(a) | $ | 240.2 | $ | 91.5 | $ | 121.6 | $ | 32.4 | $ | 485.7 | $ | 229.4 | $ | 82.5 | $ | 116.0 | $ | 29.3 | $ | 457.2 | |||||||||||||||||

| Real property – transient | 0.2 | 114.2 | 10.2 | 23.8 | 148.4 | 0.3 | 128.5 | 9.8 | 23.0 | 161.6 | |||||||||||||||||||||||||||

| Total operating revenues | 240.4 | 205.7 | 131.8 | 56.2 | 634.1 | 229.7 | 211.0 | 125.8 | 52.3 | 618.8 | |||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||||

| Property operating expenses | 82.1 | 88.7 | 46.7 | 27.4 | 244.9 | 76.6 | 82.8 | 42.7 | 23.3 | 225.4 | |||||||||||||||||||||||||||

| Real Property NOI | $ | 158.3 | $ | 117.0 | $ | 85.1 | $ | 28.8 | $ | 389.2 | $ | 153.1 | $ | 128.2 | $ | 83.1 | $ | 29.0 | $ | 393.4 | |||||||||||||||||

| Nine Months Ended September 30, 2024 | Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||||

| Financial Information | MH | RV | Marinas | UK | Total | MH | RV | Marinas | UK | Total | |||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||||

| Real property (excluding transient)(a) | $ | 717.1 | $ | 242.1 | $ | 325.3 | $ | 98.9 | $ | 1,383.4 | $ | 676.9 | $ | 217.0 | $ | 306.4 | $ | 85.2 | $ | 1,285.5 | |||||||||||||||||

| Real property – transient | 0.9 | 216.3 | 21.8 | 40.0 | 279.0 | 1.1 | 241.8 | 20.2 | 37.8 | 300.9 | |||||||||||||||||||||||||||

| Total operating revenues | 718.0 | 458.4 | 347.1 | 138.9 | 1,662.4 | 678.0 | 458.8 | 326.6 | 123.0 | 1,586.4 | |||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||||

| Property operating expenses | 236.5 | 216.0 | 127.4 | 76.1 | 656.0 | 223.0 | 209.9 | 119.1 | 70.3 | 622.3 | |||||||||||||||||||||||||||

| Real Property NOI | $ | 481.5 | $ | 242.4 | $ | 219.7 | $ | 62.8 | $ | 1,006.4 | $ | 455.0 | $ | 248.9 | $ | 207.5 | $ | 52.7 | $ | 964.1 | |||||||||||||||||

| As of September 30, 2024 | As of September 30, 2023 | ||||||||||||||||||||||||||||||||||||

| Other Information | MH | RV | Marinas | UK | Total | MH | RV | Marinas | UK | Total | |||||||||||||||||||||||||||

| Number of Properties | 288 | 179 | 138 | 54 | 659 | 298 | 182 | 135 | 55 | 670 | |||||||||||||||||||||||||||

| Sites, Wet Slips and Dry Storage Spaces | |||||||||||||||||||||||||||||||||||||

| Sites, wet slips and dry storage spaces(b) | 97,300 | 34,480 | 48,760 | 17,790 | 198,330 | 100,200 | 32,150 | 48,030 | 18,050 | 198,430 | |||||||||||||||||||||||||||

| Transient sites | N/A | 25,060 | N/A | 4,500 | 29,560 | N/A | 26,490 | N/A | 3,280 | 29,770 | |||||||||||||||||||||||||||

| Total | 97,300 | 59,540 | 48,760 | 22,290 | 227,890 | 100,200 | 58,640 | 48,030 | 21,330 | 228,200 | |||||||||||||||||||||||||||

| Occupancy | 96.9 | % | 100.0 | % | N/A | 91.5 | % | 97.0 | % | 96.3 | % | 100.0 | % | N/A | 90.6 | % | 96.4 | % | |||||||||||||||||||

N/M = Not meaningful. N/A = Not applicable.

(a) Refer to “Utility Revenues” within Definitions and Notes for additional information.

(b) MH annual sites included 10,794 and 9,834 rental homes in the Company’s rental program at September 30, 2024 and 2023, respectively. The Company’s investment in occupied rental homes at September 30, 2024 was $729.5 million, an increase of 11.2% from $655.8 million at September 30, 2023.

Real Property Operations – North America Same Property Portfolio(a)

(amounts in millions, except for statistical information)

| Quarter Ended September 30, 2024 | Quarter Ended September 30, 2023 | Total Change | % Change(c) | ||||||||||||||||||||||||||||||||||||

| MH(b) | RV(b) | Marina | Total | MH(b) | RV(b) | Marina | Total | MH | RV | Marina | Total | ||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||

| Same Property Revenues | |||||||||||||||||||||||||||||||||||||||

| Real property (excluding transient) | $ | 217.5 | $ | 82.2 | $ | 107.1 | $ | 406.8 | $ | 204.3 | $ | 74.5 | $ | 102.0 | $ | 380.8 | $ | 26.0 | 6.5 | % | 10.3 | % | 5.0 | % | 6.8 | % | |||||||||||||

| Real property – transient | 0.2 | 102.0 | 9.9 | 112.1 | 0.3 | 113.8 | 9.6 | 123.7 | (11.6 | ) | (32.4)% | (10.4)% | 2.5 | % | (9.4)% | ||||||||||||||||||||||||

| Total Same Property operating revenues | 217.7 | 184.2 | 117.0 | 518.9 | 204.6 | 188.3 | 111.6 | 504.5 | 14.4 | 6.4 | % | (2.2)% | 4.8 | % | 2.8 | % | |||||||||||||||||||||||

| Same Property Expenses | |||||||||||||||||||||||||||||||||||||||

| Same Property operating expenses(d)(e) | 61.4 | 75.5 | 37.4 | 174.3 | 56.2 | 71.6 | 34.0 | 161.8 | 12.5 | 9.2 | % | 5.4 | % | 10.0 | % | 7.7 | % | ||||||||||||||||||||||

| Real Property NOI(e) | $ | 156.3 | $ | 108.7 | $ | 79.6 | $ | 344.6 | $ | 148.4 | $ | 116.7 | $ | 77.6 | $ | 342.7 | $ | 1.9 | 5.3 | % | (6.9)% | 2.5 | % | 0.5 | % | ||||||||||||||

| Nine Months Ended September 30, 2024 | Nine Months Ended September 30, 2023 | Total Change | % Change(c) | ||||||||||||||||||||||||||||||||||||

| MH(b) | RV(b) | Marina | Total | MH(b) | RV(b) | Marina | Total | MH | RV | Marina | Total | ||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||

| Same Property Revenues | |||||||||||||||||||||||||||||||||||||||

| Real property (excluding transient) | $ | 646.0 | $ | 221.3 | $ | 282.0 | $ | 1,149.3 | $ | 604.7 | $ | 198.6 | $ | 266.9 | $ | 1,070.2 | $ | 79.1 | 6.8 | % | 11.4 | % | 5.7 | % | 7.4 | % | |||||||||||||

| Real property – transient | 0.9 | 193.8 | 21.2 | 215.9 | 0.9 | 218.7 | 20.0 | 239.6 | (23.7 | ) | (4.4)% | (11.4)% | 5.8 | % | (9.9)% | ||||||||||||||||||||||||

| Total Same Property operating revenues | 646.9 | 415.1 | 303.2 | 1,365.2 | 605.6 | 417.3 | 286.9 | 1,309.8 | 55.4 | 6.8 | % | (0.5)% | 5.7 | % | 4.2 | % | |||||||||||||||||||||||

| Same Property Expenses | |||||||||||||||||||||||||||||||||||||||

| Same Property operating expenses(d)(e) | 176.4 | 185.5 | 101.2 | 463.1 | 164.4 | 180.1 | 94.5 | 439.0 | 24.1 | 7.3 | % | 3.0 | % | 7.0 | % | 5.5 | % | ||||||||||||||||||||||

| Real Property NOI(e) | $ | 470.5 | $ | 229.6 | $ | 202.0 | $ | 902.1 | $ | 441.2 | $ | 237.2 | $ | 192.4 | $ | 870.8 | $ | 31.3 | 6.6 | % | (3.2)% | 5.0 | % | 3.6 | % | ||||||||||||||

| Other Information | |||||||||||||||||||||||||||||||||||||||

| Number of properties | 283 | 164 | 127 | 574 | 283 | 164 | 127 | 574 | |||||||||||||||||||||||||||||||

| Sites, wet slips and dry storage spaces | 96,500 | 55,690 | 43,350 | 195,540 | 96,340 | 55,190 | 43,460 | 194,990 | |||||||||||||||||||||||||||||||

(a) Refer to Definitions and Notes for additional information.

(b) Same Property results for the Company’s MH and RV properties reflect constant currency for comparative purposes. Canadian dollar figures in the prior comparative period have been translated at the average exchange rate of $0.7332 and $0.7353 USD per CAD, respectively, during the quarter and nine months ended September 30, 2024.

(c) Percentages are calculated based on unrounded numbers.

(d) Refer to “Utility Revenues” within Definitions and Notes for additional information.

Real Property Operations – North America Same Property Portfolio(a) (Continued)

(amounts in millions, except for statistical information)

(e) Total Same Property operating expenses consist of the following components for the periods shown (in millions) and exclude amounts invested into recently acquired properties to bring them up to the Company’s standards:

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||||

| September 30, 2024 | September 30, 2023 | Change | % Change(c) | September 30, 2024 | September 30, 2023 | Change | % Change(c) | ||||||||||||||||||

| Payroll and benefits | $ | 58.1 | $ | 57.3 | $ | 0.8 | 1.3 | % | $ | 152.2 | $ | 150.2 | $ | 2.0 | 1.4 | % | |||||||||

| Real estate taxes | 28.3 | 26.4 | 1.9 | 7.2 | % | 85.0 | 81.2 | 3.8 | 4.7 | % | |||||||||||||||

| Supplies and repairs | 26.3 | 22.9 | 3.4 | 14.8 | % | 63.9 | 57.5 | 6.4 | 11.1 | % | |||||||||||||||

| Utilities | 20.1 | 18.6 | 1.5 | 8.1 | % | 50.4 | 48.8 | 1.6 | 3.3 | % | |||||||||||||||

| Legal, state / local taxes, and insurance | 13.4 | 14.1 | (0.7 | ) | (4.8)% | 42.1 | 42.4 | (0.3 | ) | (0.7)% | |||||||||||||||

| Other | 28.1 | 22.5 | 5.6 | 24.7 | % | 69.5 | 58.9 | 10.6 | 18.0 | % | |||||||||||||||

| Total Same Property Operating Expenses | $ | 174.3 | $ | 161.8 | $ | 12.5 | 7.7 | % | $ | 463.1 | $ | 439.0 | $ | 24.1 | 5.5 | % | |||||||||

| As of | ||||||||||||||||

| September 30, 2024 | September 30, 2023 | |||||||||||||||

| MH | RV | MH | RV | |||||||||||||

| Other Information | ||||||||||||||||

| Number of properties | 283 | 164 | 283 | 164 | ||||||||||||

| Sites | ||||||||||||||||

| MH and annual RV sites | 96,500 | 33,630 | 96,340 | 31,970 | ||||||||||||

| Transient RV sites | N/A | 22,060 | N/A | 23,220 | ||||||||||||

| Total | 96,500 | 55,690 | 96,340 | 55,190 | ||||||||||||

| MH and Annual RV Occupancy | ||||||||||||||||

| Occupancy(b) | 97.3 | % | 100.0 | % | 96.8 | % | 100.0 | % | ||||||||

| Monthly base rent per site | $ | 701 | $ | 618 | $ | 662 | $ | 579 | ||||||||

| % Change of monthly base rent(c) | 5.9 | % | 6.7 | % | N/A | N/A | ||||||||||

| Rental Program Statistics included in MH | ||||||||||||||||

| Number of occupied sites, end of period(d) | 10,210 | N/A | 9,490 | N/A | ||||||||||||

| Monthly rent per site – MH rental program | $ | 1,338 | N/A | $ | 1,285 | N/A | ||||||||||

| % Change(d) | 4.1 | % | N/A | N/A | N/A | |||||||||||

N/A = Not applicable.

(a) Refer to Definitions and Notes for additional information.

(b) Same Property blended occupancy for MH and RV was 98.0% at September 30, 2024, up 40 basis points from 97.6% at September 30, 2023. Adjusting for recently delivered and vacant expansion sites, Same Property adjusted blended occupancy for MH and RV increased by 160 basis points year over year, to 98.8% at September 30, 2024, from 97.2% at September 30, 2023.

(c) Calculated using actual results without rounding.

(d) Occupied rental program sites in Same Property are included in total sites.

Real Property Operations – UK Same Property Portfolio(a)

(amounts in millions, except for statistical information)

| Quarter Ended | Nine Months Ended | ||||||||||||||||

| September 30, 2024 | September 30, 2023 | % Change(c) | September 30, 2024 | September 30, 2023 | % Change(c) | ||||||||||||

| Financial Information(b) | |||||||||||||||||

| Same Property Revenues | |||||||||||||||||

| Real property (excluding transient) | $ | 26.6 | $ | 25.3 | 5.0 | % | $ | 76.2 | $ | 71.4 | 6.8 | % | |||||

| Real property – transient | 23.8 | 23.5 | 1.3 | % | 40.0 | 38.4 | 4.0 | % | |||||||||

| Total Same Property operating revenues | 50.4 | 48.8 | 3.2 | % | 116.2 | 109.8 | 5.8 | % | |||||||||

| Same Property Expenses | |||||||||||||||||

| Same Property operating expenses(d) | 21.0 | 18.7 | 12.2 | % | 56.2 | 54.1 | 3.9 | % | |||||||||

| Real Property NOI | $ | 29.4 | $ | 30.1 | (2.3)% | $ | 60.0 | $ | 55.7 | 7.7 | % | ||||||

| As of | ||||||||||||

| September 30, 2024 | September 30, 2023 | Change | ||||||||||

| Other Information | ||||||||||||

| Number of properties | 52 | 52 | — | |||||||||

| Sites | ||||||||||||

| UK sites | 16,620 | 16,540 | 80 | |||||||||

| UK transient sites | 3,350 | 3,140 | 210 | |||||||||

| Occupancy(e) | 91.6 | % | 90.5 | % | 1.1 | % | ||||||

| Monthly base rent per site | $ | 545 | $ | 527 | $ | 18 | ||||||

(a) Refer to Definitions and Notes for additional information.

(b) Same Property results for the Company’s UK properties reflect constant currency for comparative purposes. British pound sterling figures in the prior comparative period have been translated at the average exchange rate of $1.3009 USD and $1.2769 USD per GBP, respectively, during the quarter and nine months ended September 30, 2024.

(c) Percentages are calculated based on unrounded numbers.

(d) Refer to “Utility Revenues” within Definitions and Notes for additional information.

(e) Adjusting for recently delivered and vacant expansion sites, Same Property adjusted occupancy increased by 120 basis points year over year, to 91.9% at September 30, 2024, from 90.7% at September 30, 2023.

Home Sales Summary

($ in millions, except for average selling price)

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||

| Financial Information | September 30, 2024 | September 30, 2023 | % Change | September 30, 2024 | September 30, 2023 | % Change | |||||||||||||||

| MH | |||||||||||||||||||||

| Home sales | $ | 47.0 | $ | 62.4 | (24.7)% | $ | 138.0 | $ | 171.9 | (19.7)% | |||||||||||

| Home cost and selling expenses | 38.2 | 49.5 | (22.8)% | 109.4 | 131.5 | (16.8)% | |||||||||||||||

| NOI(a) | $ | 8.8 | $ | 12.9 | (31.8)% | $ | 28.6 | $ | 40.4 | (29.2)% | |||||||||||

| NOI margin %(a) | 18.7 | % | 20.7 | % | 20.7 | % | 23.5 | % | |||||||||||||

| UK | |||||||||||||||||||||

| Home sales | $ | 58.3 | $ | 55.4 | 5.2 | % | $ | 143.7 | $ | 154.8 | (7.2)% | ||||||||||

| Home cost and selling expenses | 36.1 | 35.0 | 3.1 | % | 93.6 | 102.0 | (8.2)% | ||||||||||||||

| NOI(a) | $ | 22.2 | $ | 20.4 | 8.8 | % | $ | 50.1 | $ | 52.8 | (5.1)% | ||||||||||

| NOI margin %(a) | 38.1 | % | 36.8 | % | 34.9 | % | 34.1 | % | |||||||||||||

| Total | |||||||||||||||||||||

| Home sales | $ | 105.3 | $ | 117.8 | (10.6)% | $ | 281.7 | $ | 326.7 | (13.8)% | |||||||||||

| Home cost and selling expenses | 74.3 | 84.5 | (12.1)% | 203.0 | 233.5 | (13.1)% | |||||||||||||||

| NOI(a) | $ | 31.0 | $ | 33.3 | (6.9)% | $ | 78.7 | $ | 93.2 | (15.6)% | |||||||||||

| NOI margin %(a) | 29.4 | % | 28.3 | % | 27.9 | % | 28.5 | % | |||||||||||||

| Other information | |||||||||||||||||||||

| Units Sold: | |||||||||||||||||||||

| MH | 557 | 636 | (12.4)% | 1,507 | 1,909 | (21.1)% | |||||||||||||||

| UK | 936 | 884 | 5.9 | % | 2,344 | 2,310 | 1.5 | % | |||||||||||||

| Total home sales | 1,493 | 1,520 | (1.8)% | 3,851 | 4,219 | (8.7)% | |||||||||||||||

| Average Selling Price: | |||||||||||||||||||||

| MH | $ | 84,381 | $ | 98,113 | (14.0)% | $ | 91,573 | $ | 90,047 | 1.7 | % | ||||||||||

| UK | $ | 62,286 | $ | 62,670 | (0.6)% | $ | 61,305 | $ | 67,013 | (8.5)% | |||||||||||

(a) Refer to Definitions and Notes for additional information.

Operating Statistics for MH and Annual RVs

| Resident Move-outs | |||||||||||||

| % of Total Sites | Number of Move-outs | Leased Sites, Net(b) | New Home Sales | Pre-owned Home Sales | Brokered Re-sales | ||||||||

| 2024 – YTD as of September 30 | 3.9 | % | (a) | 5,694 | 2,499 | 339 | 1,168 | 1,334 | |||||

| 2023 | 3.6 | % | 6,590 | 3,268 | 564 | 2,001 | 2,296 | ||||||

| 2022 | 3.0 | % | 5,170 | 2,922 | 703 | 2,509 | 2,864 | ||||||

(a) Percentage calculated on a trailing 12-month basis.

(b) Increase in revenue producing sites, net of new vacancies.

Acquisitions and Dispositions

(amounts in millions, except for *)

| Property Name | Property Type | Number of Properties* | Sites, Wet Slips and Dry Storage Spaces* | State, Province or Country | Total Purchase Price / Sales Proceeds | Month | |||||||

| ACQUISITIONS | |||||||||||||

| First Quarter 2024 | |||||||||||||

| Port of San Juan(a) | Marina | 1 | 8 | PR | $ | — | March | ||||||

| Second Quarter 2024 | |||||||||||||

| Port Milford(b) | Marina | 1 | 92 | CT | 4.0 | April | |||||||

| Oak Leaf(c) | Marina | — | 89 | CT | 5.0 | April | |||||||

| Berth One Palm Beach(c) | Marina | — | 4 | FL | 3.0 | April | |||||||

| Third Quarter 2024 | |||||||||||||

| Marina Village Yacht Harbor(d) | Marina | 1 | 732 | CA | 50.0 | September | |||||||

| Ventura Harbor Fuel(c) | Marina | — | — | CA | 1.8 | September | |||||||

| Acquisitions to Date | 3 | 925 | $ | 63.8 | |||||||||

| DISPOSITIONS | |||||||||||||

| First Quarter 2024 | |||||||||||||

| Spanish Trails and Sundance | MH | 2 | 533 | AZ & FL | $ | 48.5 | February | ||||||

| Second Quarter 2024 | |||||||||||||

| Littondale | UK | 1 | 114 | UK | 5.9 | May | |||||||

| Third Quarter 2024 | |||||||||||||

| Six Community MH Portfolio | MH | 6 | 2,090 | Various | 224.6 | July | |||||||

| Lake Pointe Village | MH | 1 | 361 | FL | 38.0 | July | |||||||

| Reserve at Fox Creek | MH | 1 | 311 | AZ | 38.0 | September | |||||||

| Dispositions to Date | 11 | 3,409 | $ | 355.0 | |||||||||

(a) Acquired via ground lease agreement.

(b) In conjunction with this acquisition, the Company issued 19,326 common OP units valued at $2.5million.

(c) Combined with an existing property.

(d) In conjunction with this acquisition, the Company issued 243,273 common OP units valued at $31.5million.

Capital Expenditures and Investments

(amounts in millions, except for *)

| Nine Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||

| September 30, 2024 | December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||||||||||

| MH / RV | Marina | UK | Total | MH / RV | Marina | UK | Total | MH / RV | Marina | UK | Total | ||||||||||||||||||||||||

| Recurring Capital Expenditures(a) | $ | 48.5 | $ | 34.1 | $ | 6.4 | $ | 89.0 | $ | 51.8 | $ | 35.5 | $ | — | $ | 87.3 | $ | 51.0 | $ | 22.8 | $ | — | $ | 73.8 | |||||||||||

| Non-Recurring Capital Expenditures(a) | |||||||||||||||||||||||||||||||||||

| Lot Modifications | $ | 25.3 | N/A | $ | 1.7 | $ | 27.0 | $ | 54.9 | N/A | $ | — | $ | 54.9 | $ | 39.1 | N/A | $ | — | $ | 39.1 | ||||||||||||||

| Growth Projects | 6.1 | 67.7 | 4.8 | 78.6 | 21.6 | 82.9 | — | 104.5 | 28.4 | 71.1 | — | 99.5 | |||||||||||||||||||||||

| Rebranding | — | N/A | 3.0 | 3.0 | 4.7 | N/A | — | 4.7 | 15.0 | N/A | — | 15.0 | |||||||||||||||||||||||

| Acquisitions | 34.0 | 129.9 | 10.5 | 174.4 | 115.1 | 186.3 | 67.3 | 368.7 | 503.0 | 522.5 | 2,285.1 | 3,310.6 | |||||||||||||||||||||||

| Expansion and Development | 86.8 | 6.9 | 11.5 | 105.2 | 247.4 | 26.0 | 2.9 | 276.3 | 243.8 | 13.9 | 4.1 | 261.8 | |||||||||||||||||||||||

| Total Non-Recurring Capital Expenditures | 152.2 | 204.5 | 31.5 | 388.2 | 443.7 | 295.2 | 70.2 | 809.1 | 829.3 | 607.5 | 2,289.2 | 3,726.0 | |||||||||||||||||||||||

| Total | $ | 200.7 | $ | 238.6 | $ | 37.9 | $ | 477.2 | $ | 495.5 | $ | 330.7 | $ | 70.2 | $ | 896.4 | $ | 880.3 | $ | 630.3 | $ | 2,289.2 | $ | 3,799.8 | |||||||||||

| Other Information | |||||||||||||||||||||||||||||||||||

| Recurring Capex per Site, Slip and Dry Storage Spaces(b)* | $ | 329 | $ | 709 | $ | 353 | $ | 417 | $ | 388 | $ | 867 | N/A | $ | 500 | $ | 397 | $ | 582 | N/A | $ | 441 | |||||||||||||

N/A = Not applicable.

(a) Refer to Definitions and Notes for additional information.

(b) Average based on actual number of MH and RV sites, Marina wet slips and dry storage spaces, and UK sites associated with the recurring capital expenditures in each period.

Capitalization Overview

(Shares and units in thousands, dollar amounts in millions, except for *)

| As of | |||||||||

| September 30, 2024 | |||||||||

| Equity and Enterprise Value | Common Equivalent Shares | Share Price* | Capitalization | ||||||

| Common shares | 127,397 | $ | 135.15 | $ | 17,217.7 | ||||

| Convertible securities | |||||||||

| Common OP units | 2,922 | $ | 135.15 | 394.9 | |||||

| Preferred OP units | 2,571 | $ | 135.15 | 347.5 | |||||

| Diluted shares outstanding and market capitalization(a) | 132,890 | 17,960.1 | |||||||

| Plus: Total debt, per consolidated balance sheet | 7,324.8 | ||||||||

| Total capitalization | 25,284.9 | ||||||||

| Less: Cash and cash equivalents (excluding restricted cash) | (63.6 | ) | |||||||

| Enterprise Value(b) | $ | 25,221.3 | |||||||

| Debt | Weighted Average Maturity (in years)* | Debt Outstanding | |||||||

| Mortgage loans payable | 8.3 | $ | 3,344.5 | ||||||

| Secured borrowings on collateralized receivables(c) | 13.5 | 52.8 | |||||||

| Unsecured debt | 4.8 | 3,927.5 | |||||||

| Total carrying value of debt, per consolidated balance sheet | 6.4 | 7,324.8 | |||||||

| Plus: Unamortized deferred financing costs and discounts / premiums on debt | 36.3 | ||||||||

| Total Debt | $ | 7,361.1 | |||||||

| Corporate Debt Rating and Outlook | |||||||||

| Moody’s | Baa3 | Stable | ||||||||

| S&P | BBB | Stable | ||||||||

(a) Refer to “Securities” within Definitions and Notes for additional information related to the Company’s securities outstanding.

(b) Refer to “Enterprise Value” within Definitions and Notes for additional information.

(c) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

Summary of Outstanding Debt

(amounts in millions, except for *)

| Quarter Ended | ||||||||

| September 30, 2024 | ||||||||

| Debt Outstanding | Weighted Average Interest Rate(a)* | Maturity Date* | ||||||

| Secured Debt: | ||||||||

| Mortgage loans payable | $ | 3,344.5 | 3.99 | % | Various | |||

| Secured borrowings on collateralized receivables(b) | 52.8 | 8.58 | % | Various | ||||

| Total Secured Debt | 3,397.3 | 4.06 | % | |||||

| Unsecured Debt: | ||||||||

| Senior Credit Facility: | ||||||||

| Revolving credit facilities (in USD)(c) | 1,252.0 | 4.72 | % | April 2026 | ||||

| Senior Unsecured Notes: | ||||||||

| 2028 senior unsecured notes | 447.3 | 2.30 | % | November 2028 | ||||

| 2029 senior unsecured notes | 496.0 | 5.55 | % | January 2029 | ||||

| 2031 senior unsecured notes | 743.2 | 2.70 | % | July 2031 | ||||

| 2032 senior unsecured notes | 593.0 | 3.60 | % | April 2032 | ||||

| 2033 senior unsecured notes | 396.0 | 5.51 | % | January 2033 | ||||

| Total Senior Unsecured Notes | 2,675.5 | 3.78 | % | |||||

| Total Unsecured Debt | 3,927.5 | 4.08 | % | |||||

| Total carrying value of debt, per consolidated balance sheets | 7,324.8 | 4.07 | % | |||||

| Plus: Unamortized deferred financing costs, discounts / premiums on debt, and fair value adjustments(a) | 36.3 | |||||||

| Total debt | $ | 7,361.1 | ||||||

(a)Includes the effect of amortizing deferred financing costs, loan premiums / discounts, and derivatives, as well as fair value adjustments on the Secured borrowings on collateralized receivables.

(b)Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

(c)As of September 30, 2024, the Company’s revolving credit facilities consisted of:

- $226.0 million borrowed on its U.S. line of credit at the Secured Overnight Financing Rate (“SOFR”) plus 85 basis points margin. As of September 30, 2024, $150.0million was swapped to a weighted average fixed SOFR rate of 4.757% for an all-in fixed rate of 5.707%.

- $1.0 billion (£756.5 million) borrowed on its GBP and multicurrency lines of credit at the Daily Sterling Overnight Index Average (“SONIA”) base rate, plus 85 basis points margin. As of September 30, 2024, $669.7million (£500.0million) was swapped to a weighted average fixed SONIA rate of 2.924% for an all-in fixed rate of 3.806% inclusive of margin.

- $12.8 million USD equivalent borrowed on its AUD line of credit at the Bank Bill Swap Bid Rate (“BBSY”) plus 85 basis points margin.

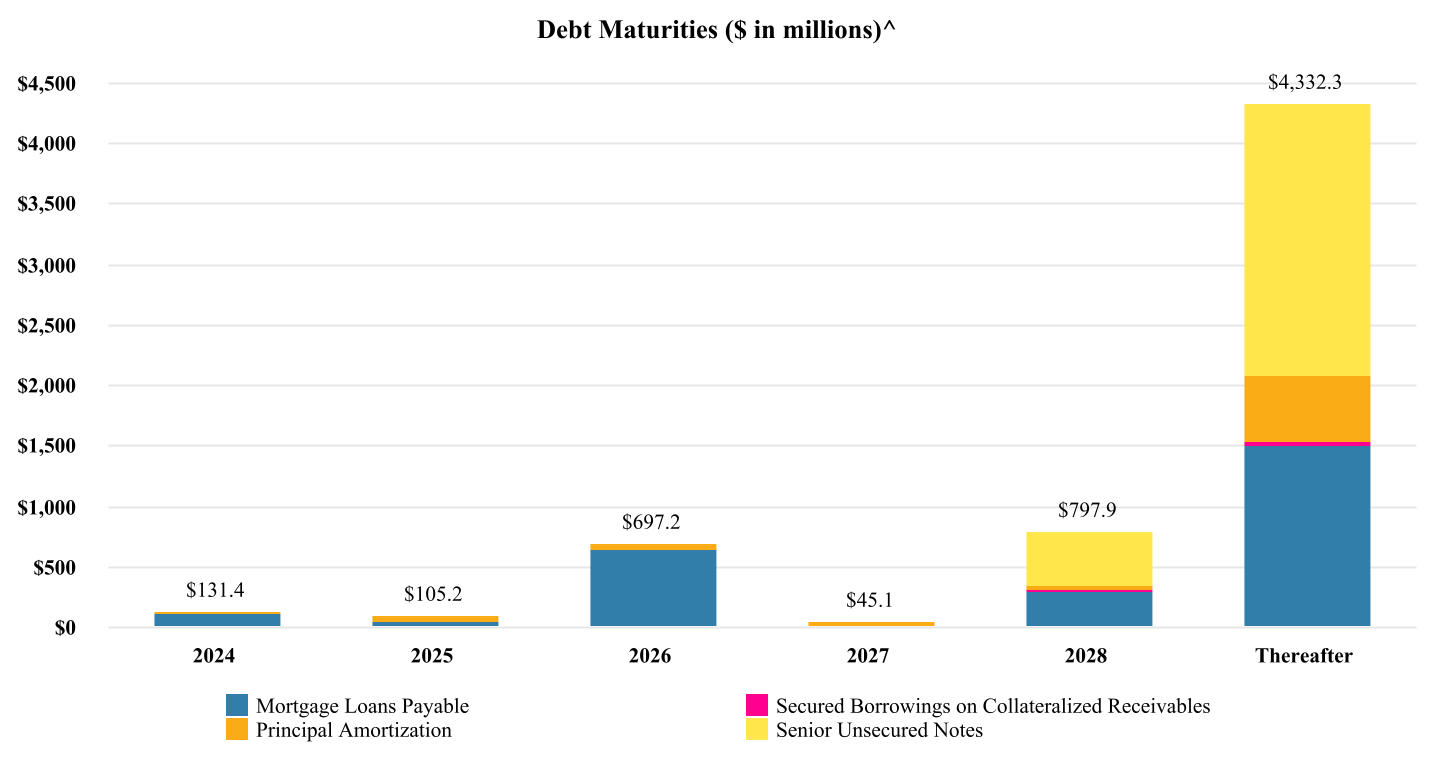

Debt Maturities(a)

(amounts in millions, except for *)

| As of | ||||||||||||||||||

| September 30, 2024 | ||||||||||||||||||

| Year | Mortgage Loans Payable(b) | Principal Amortization | Secured Borrowings on Collateralized Receivables(c)(d) | Senior Credit Facility | Senior Unsecured Notes | Total | ||||||||||||

| 2024 | $ | 117.2 | $ | 13.6 | $ | 0.6 | $ | — | $ | — | $ | 131.4 | ||||||

| 2025 | 50.6 | 52.3 | 2.3 | — | — | 105.2 | ||||||||||||

| 2026 | 650.5 | 44.2 | 2.5 | 1,252.0 | — | 1,949.2 | ||||||||||||

| 2027 | 4.0 | 38.3 | 2.8 | — | — | 45.1 | ||||||||||||

| 2028 | 303.9 | 41.0 | 3.0 | — | 450.0 | 797.9 | ||||||||||||

| Thereafter | 1,504.0 | 540.7 | 37.6 | — | 2,250.0 | 4,332.3 | ||||||||||||

| Total | $ | 2,630.2 | $ | 730.1 | $ | 48.8 | $ | 1,252.0 | $ | 2,700.0 | $ | 7,361.1 | ||||||

(a) Debt maturities include the unamortized deferred financing costs, discount / premiums, and fair value adjustments associated with outstanding debt.

(b) For the Mortgage loans payable maturing between 2024 – 2028:

| 2024 | 2025 | 2026 | 2027 | 2028 | ||||||||||

| Weighted average interest rate | 4.03 | % | 4.04 | % | 3.97 | % | 4.34 | % | 4.04 | % |

(c) Balance at September 30, 2024 excludes fair value adjustments of $4.0million.

(d) Refer to “Secured borrowings on collateralized receivables” within Definitions and Notes for additional information.

^ Excludes the Company’s borrowings under its senior credit facility.

Debt Analysis

| As of | |||||

| September 30, 2024 | |||||

| Select Credit Ratios | |||||

| Net Debt / TTM recurring EBITDA(a) | 6.0 x | ||||

| Net Debt / Enterprise Value(a) | 28.8 | % | |||

| Net Debt / gross assets(a) | 35.0 | % | |||

| Unencumbered assets / total assets | 77.8 | % | |||

| Floating rate debt / total debt(b) | 5.9 | % | |||

| Coverage Ratios | |||||

| TTM Recurring EBITDA(a)(b) / interest | 3.4 x | ||||

| TTM Recurring EBITDA(a)(b) / interest + preferred distributions + preferred stock distribution | 3.4 x | ||||

| Senior Credit Facility Covenants | Requirement | ||||