With more than 175 locations open or on the way, EoS Fitness is a leader in the fitness industry, offering an inclusive and welcoming environment for exercise practitioners of every level. The brand offers top-of-the-line health, fitness and wellness amenities, a variety of high-energy group fitness classes and innovative recovery options where members can focus on improving their overall wellbeing and achieving their fitness goals. EoS Fitness draws steady, repeat foot traffic and is heavily embedded with the communities in which it operates.

“Whitestone enjoys a strong sense of connection with the neighborhoods we serve, and it is deeply important to us that we bring in brands like EoS Fitness that align with our community-oriented and customer-first mission,” stated Christine Mastandrea, COO of Whitestone REIT. “We truly believe that is the reason our customers continue frequenting our centers and why we stand out among today’s most exciting and forward-thinking retailers and restaurants. This unique approach has proven highly effective at creating sustained value for all of our stakeholders.”

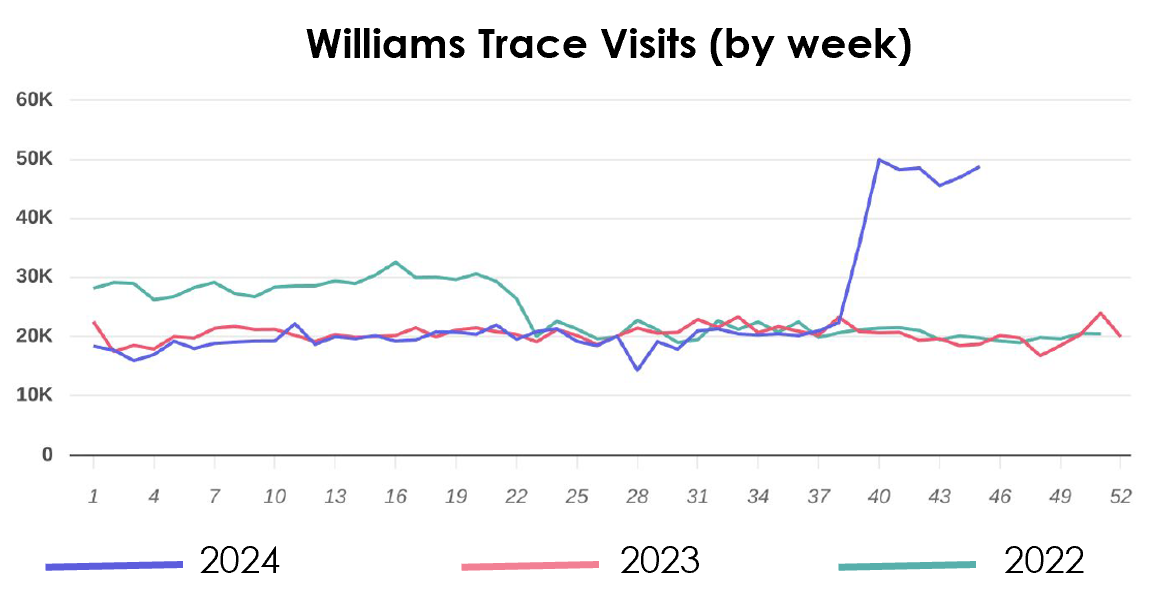

Since opening its state-of-the-art, 51,530-square-foot facility at Williams Trace Plaza in September 2024, EoS Fitness has boosted customer traffic by 60%, reflecting the strong and loyal following the in-demand gym chain attracts. Whitestone expects EoS Fitness to have a similar impact on foot traffic at Windsor Park Center when it opens in 2026.

“We have worked hard to remerchandise our centers over the last few quarters in order to drive Same Store NOI Growth, provide our communities with better optionality, and increase shareholder value,” said Dave Holeman, CEO of Whitestone REIT. “We continue to feel strongly that differentiated food and fitness concepts drive significant levels of repeat customer traffic and sales, and will look to these categories as we work diligently to make additional anchor upgrades throughout our portfolio.”

EoS Fitness is a synergistic addition to the retail lineups at both Windsor Park Center and Williams Trace Plaza. The full-service gym is among a host of new retailers that have recently opened at Williams Trace, joining Bank of the Orient, Engineering for Kids, Pizza Twist, Gameday Men’s Health, Loty Beauty Retreat and Rewax and Unwine. These new additions have boosted Net Operating Income (NOI) at the center by 30% from Q3 2022, which the Company expects to grow even higher in 2025 once it leases out a new pad site it is developing along heavily-traveled Williams Trace Boulevard.

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit the Company’s investor relations website.

About EoS Fitness

EoS Fitness, a leader in the fitness industry with its High Value. Low Price. (HVLP)® gyms, is an inclusive and welcoming organization committed to empowering exercise practitioners of all experience levels. With more than 175 gym locations open and on the way in Arizona, Florida, Georgia, Nevada, Southern California, Texas and Utah, EoS Fitness is rapidly expanding. Providing serious fitness options, EoS Fitness offers the best equipment, high-energy workout classes, top-notch amenities, and extensive personal training options starting at just $9.99 per month. www.EoSfitness.com.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition, pending acquisitions and the impact of such acquisitions on our financial condition and results of operations, anticipated capital expenditures required to complete projects, amounts of anticipated cash distributions to our shareholders in the future and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy, the real estate industry in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston and Phoenix in particular, including the potential impact of COVID-19 on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; inflation and increases in interest rates, operating costs or general and administrative expenses; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine; the need to fund tenant improvements or other capital expenditures out of operating cash flow; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all and other factors detailed in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Contacts:

For Whitestone REIT – Investors

David Mordy

(713) 435-2219

ir@whitestonereit.com

For Whitestone REIT – Media:

Matthew Chudoba

WhitestonePR@icrinc.com

For EoS Fitness – Media:

Melissa Rue

(208) 850-5939

mkr@nstpr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9dd565c2-1bf8-4a36-8ac8-b6482a20565c