Garden Oaks Shopping Center

Houston market Economic Trends, Supply and Demand, and Rent Trends charts

HOUSTON, Feb. 21, 2024 (GLOBE NEWSWIRE) — Whitestone REIT (NYSE:WSR) (“Whitestone” or the “Company”) today announced the acquisition of the grocery-anchored Garden Oaks Shopping Center in Houston. The center, which contains 107,000 leasable square feet and is 96% occupied, is in the pathway of significant development, both residential and commercial, and sits on a major thoroughfare in the area. The Aldi-anchored center has a mix of 19 service and convenience-based tenants, including a top performing Planet Fitness. Nearly 30,000 vehicles per day pass by on North Shepherd Drive.

Garden Oaks Shopping Center

“Garden Oaks property values are up nearly 50% since 2019, and the area is poised to continue with very strong growth as young professionals settle beyond the Heights area and take advantage of the larger plots and tree-lined streets in Garden Oaks,” said Whitestone REIT COO, Christine Mastandrea. “The center fits well with our strategy to own high quality centers that successfully serve the surrounding neighborhood.”

The acquisition is funded through Whitestone’s capital recycling efforts, focusing on portfolio improvement, through a disciplined capital recycling program that began in 2022 and now totals over $80 million in acquisitions. The program is anticipated to have sales equivalent to the total acquisition amount with 9 lower value creation potential centers sold to date and one anticipated sale in the first half of 2024. The 9 centers sold so far were sold at a combined capitalization rate of 5.9% based on trailing twelve-month NOI. Since the third quarter of 2022, Whitestone has acquired four high quality shopping centers, including Lake Woodlands Crossing, Dana Park Pad and Arcadia Towne Center.

“We are very pleased to add the Garden Oaks Shopping Center, which serves young, family-oriented professionals that live in the surrounding Garden Oaks Neighborhoods, to our portfolio. This acquisition will help drive Same Store Net Operating Income as we apply our expertise in curating the center and as the surrounding area continues its rapid development,” said Whitestone CEO, Dave Holeman.

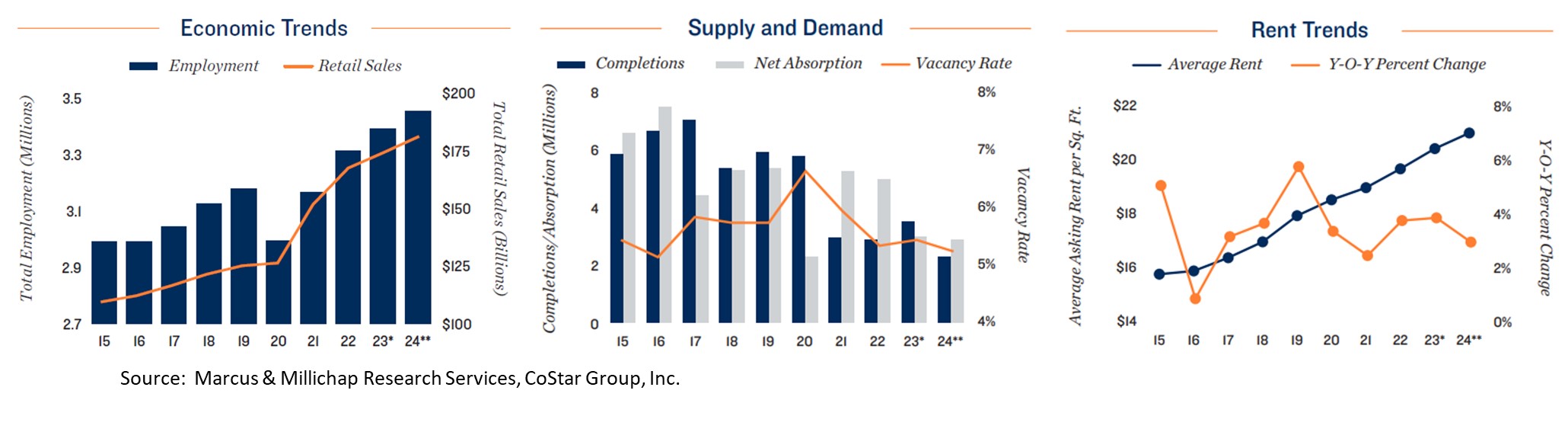

The Houston market continues to have very favorable supply/demand fundamentals, driven by a strong job market and a limited supply of new neighborhood retail centers coming online:

Houston Retail Center Supply/Demand Fundamentals

Management is looking forward to Whitestone’s March 7th earnings call and will share more details then.

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit the Company’s investor relations website.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition, pending acquisitions and the impact of such acquisitions on our financial condition and results of operations, anticipated capital expenditures required to complete projects, amounts of anticipated cash distributions to our shareholders in the future and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy, the real estate industry in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston and Phoenix in particular, including the potential impact of COVID-19 on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; inflation and increases in interest rates, operating costs or general and administrative expenses; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine; the need to fund tenant improvements or other capital expenditures out of operating cash flow; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all and other factors detailed in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Investor and Media Contact:

David Mordy

Director, Investor Relations

Whitestone REIT

(713) 435-2219

ir@whitestonereit.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8b93e2a-3e92-434c-8334-89b1edff8a58

https://www.globenewswire.com/NewsRoom/AttachmentNg/c957efa3-80db-45c7-bc47-c1e05996c331