If you’re thinking of starting a business or changing your sole proprietorship into an LLC, you most likely have a name for your business. If not you will want to think of one that you believe will capture what your business is about.

All Limited Liability Companies, more commonly known as LLCs, need to have the words “Limited Liability Company” or “LLC” as part of the name. That puts everyone on notice that the entity they’re engaging with is a separate entity and not a “natural” person.

Once you have your name picked out, you will go to the Minnesota Secretary of State’s website to begin the online process.

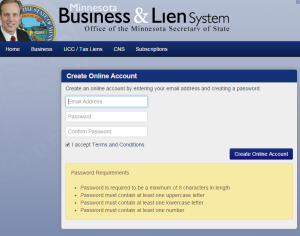

The first step is to create an online account with the Minnesota Secretary of State. You can do so by clicking HERE Then the next step is to file what’s known as “Articles of Organization”, which are similar to a corporation’s Articles of Incorporation.

You can do so by clicking on the link “Online Filing Articles of Organization for a LLC” and then click under File: “New Business, Amendment, Annual Renewal or Reinstatement”

On that page, you will enter in your business name, address and other related information. It’s ok if the address is the same as your home, and your not expected to have a separate / commercial address. In fact, I don’t know this, but if I was to guess, I would say a large proportion of new LLCs have the same address as their owners.

At the time of writing, the cost to setup a domestic LLC in Minnesota is $155. If you’re not ready to fully start an LLC, you can reserve the name you want for $55.

Once you have your LLC up and rolling, your next step is to receive the equivalent of a “social security” number for your new business, called a Federal Employer Identification Number (EIN). Even if you don’t want to hire employees, you will want an EIN because you will need it for so many things including banking and taxes. You can get an EIN by CLICKING HERE.

After you have your newly minted Minnesota LLC and EIN number, you’re ready to begin banking, sales, hiring employees, and of course, making money. In order to keep track of it all, you’ll want an accounting program. If you’re not already using an accountant, which I recommend for any new business owner(s), is to setup an accounting system. 1 Reason can recommend bookkeepers for you if you don’t have one in mind. If you want an online accounting solution that is free and easy to get started with, Wave online accounting is a great place to do-it-yourself.

Have questions? Give us a call and we’ll try our best to provide strategies to help you figure out what solutions are available and the pros and cons of each.

Lastly, I want to emphasize that simply starting a LLC, LLP, and/or corporation doesn’t mean you’re forever out of the woods when it comes to personal liability. A common mistake that many make is not treating the other entity as the separate entity it’s supposed to be. If you co-mingle funds and assets, you can jeopardize the integrity of the liability wall you tried to create to begin with. A term no limited liability entity owner ever wants to hear is “piercing the corporate veil”. Piercing the corporate veil is a term used to describe the process an attorney uses to get at personal assets because there’s no legal difference between an owner and the limited liability entity created. Co-mingling funds is one of the most common ways to lose your valuable and expensive protection, so don’t do it. Seek professional advise because a few dimes today may save you dollars later.

Leave a Comment

You must be logged in to post a comment.